E-Invoice - Frequently Asked Questions (FAQs)

1. What is e-invoice?

An e-invoice is a digital representation of a transaction exchange between a seller (supplier) and a purchaser (buyer), which goes through the government portal for validation and recordkeeping. E-Invoice replaces paper or electronic documents such as invoices, credit notes, debit notes and refund notes.

For more information, you may refer to the IRBM e-Invoice microsite:

https://www.hasil.gov.my/e-invois/.

2. What is a validated e-invoice?

An e-invoice validated by the Inland Revenue Board of Malaysia (IRBM) contains all the details of an invoice along with a Unique Identification Number (“UIN”), which is generated by the government system (MyInvois Portal) after proper verification of the core fields. A QR code will be generated after IRBM verification, and this code enables the purchaser to validate the e-invoice online.

3. How to request a validated e-invoice?

For store purchase

Please visit this link:

https://einvoice.popular.com.my or scan the QR code printed on the official receipt to request an e-invoice.

For online purchase

Please visit this link:

https://einvoice.popular.com.my or refer to the website link printed on the shipping notice to request an e-invoice.

4. Timeline for the buyer to request an e-invoice?

For store purchases or online purchases

You may request an e-invoice from the website link or QR code from 10 am

onwards on the next day of purchase and till 11:59 pm on the first (1st) calendar day of the following month of purchase.

For any request for an e-invoice that is submitted later than the stipulated timeframe, POPULAR has no obligation to issue an e-invoice to the customer.

Example 1:

The customer purchased on 1 Aug 2024, the customer is to request an e-invoice from 2 Aug 2024 at 10.00 am onwards up to the last day 1 Sept 2024 at 11.59 pm.

Example 2:

The customer purchased on 31 Aug 2024, the customer is to request an e-invoice on 1 Sept 2024 from 10.00 am onward till 11:59 pm only.

Example 3:

The customer purchased on 31 Aug 2024, the customer tried to request an e-invoice on 2 Sept at 12.05 am. This request cannot be submitted and processed by POPULAR.

5. How to fill in POPULAR’s E-Invoice Request Form?

Please refer to the table below.

| Fields |

Personal

(Including Sole Proprietorship) |

Company |

| Name / Company Name |

Jayden Lim |

Y2K Sdn. Bhd. |

| NRIC / BRN (New) |

801120045327 |

202407563484 |

| SST Number |

- |

W11-1988-42002254 |

| Email Address |

[email protected] |

[email protected] |

| Phone Number |

0126701887 |

0397182546 |

| Personal TIN / Company TIN |

IG55008888099 |

C20249900588 |

The above fields are mandatory except SST Number, which is not applicable to a company that is not SST-registered.

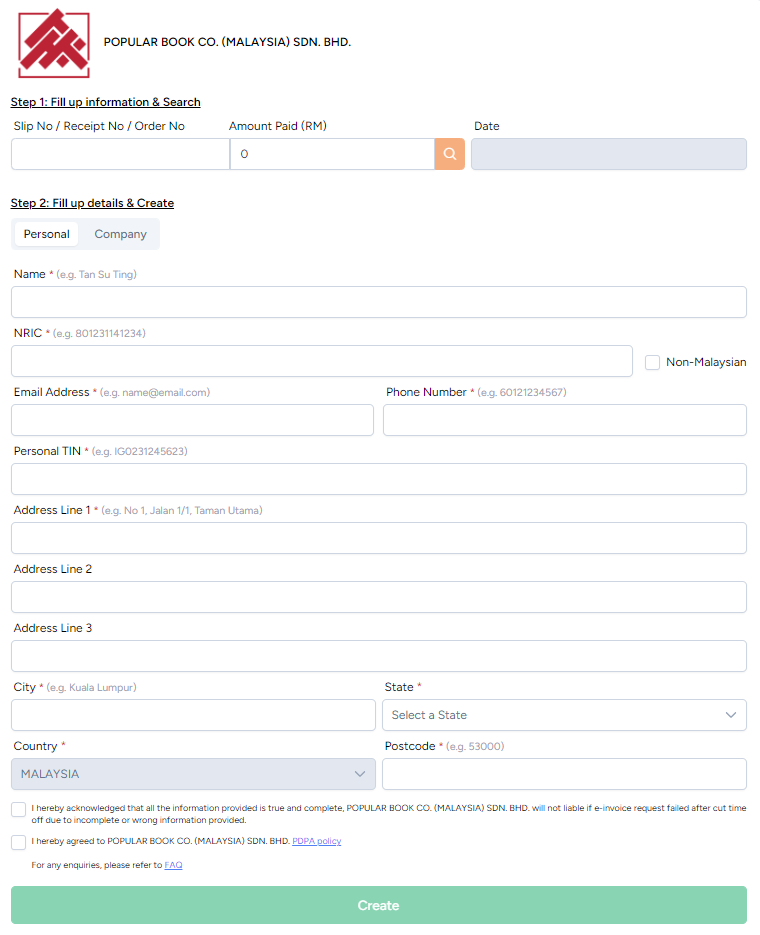

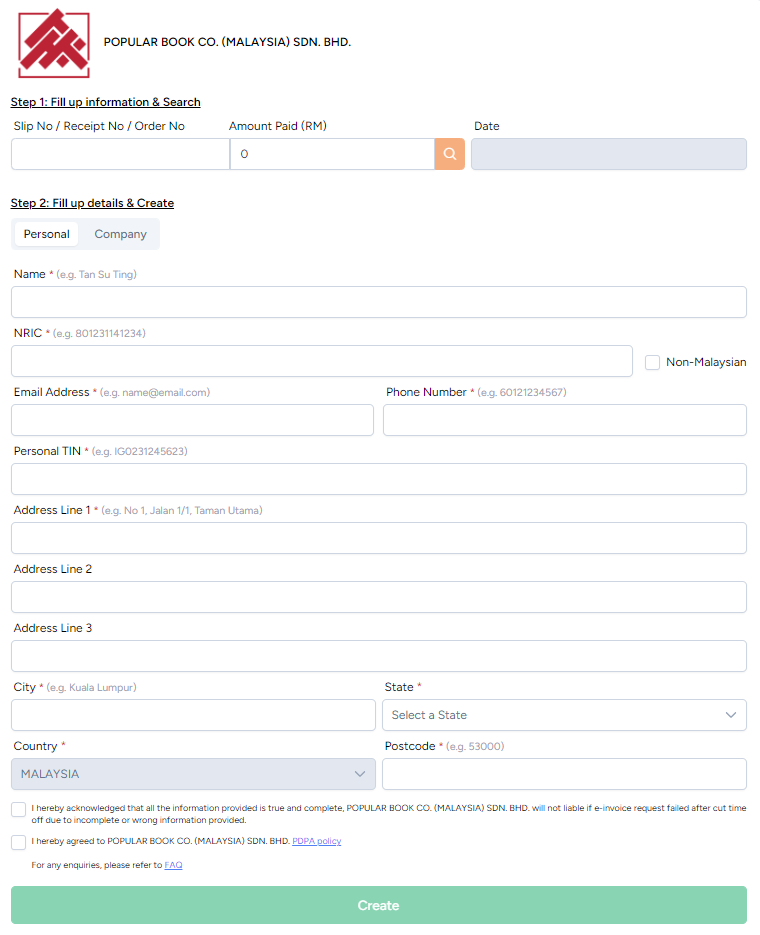

Please refer below sample E-Invoice Request Form: -

For Foreign Customer:

- Please tick “Non-Malaysian” and fill in your Passport Number.

- For Personal TIN field, please input the General TIN: “EI00000000020”.

Sample 1 - Store Receipt

For store purchases please fill up the Slip No. and Amount in the E-Invoice Request Form.

.png) Sample 2 - Home Delivery Shipping Notice

Sample 2 - Home Delivery Shipping Notice

For online purchases please fill up the Order No. and Amount (can be found from login into POPULAR Online website,

https://www.popularonline.com.my at “My Order” page) in the E-Invoice Request Form.

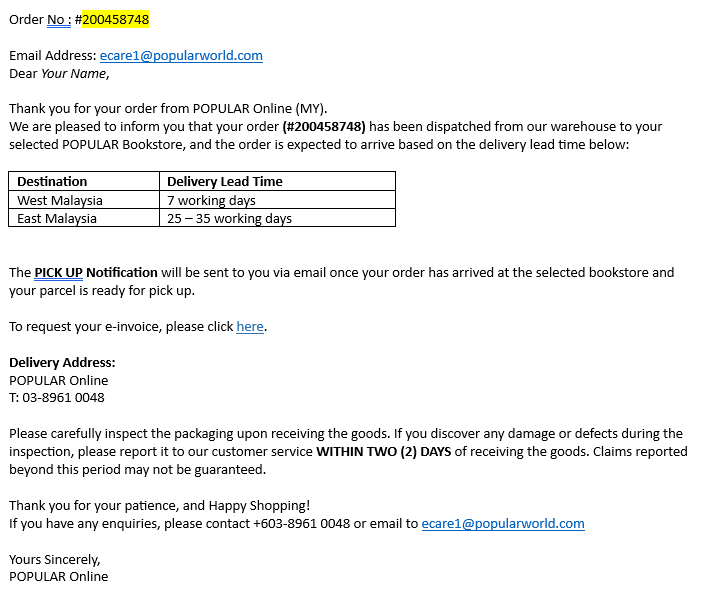

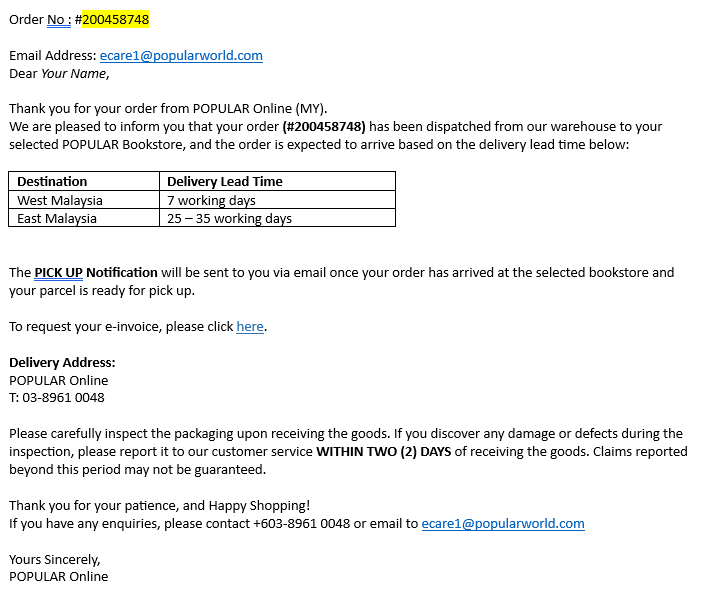

.png) Sample 3 – Store Pick-up Shipping Notice

Sample 3 – Store Pick-up Shipping Notice

For online purchases please fill up the Order No. and Amount (can be found from login into POPULAR Online website,

https://www.popularonline.com.my at “My Order” page) in the E-Invoice Request Form.

6. What is a Business Registration Number (BRN)?

6. What is a Business Registration Number (BRN)?

A Business Registration Number (BRN) contains unique numbers used to identify a registered company printed on the certificate of incorporation (Form 9) with 12-digit characters.

7. What is a Sales and Service Tax Number (SST)?

A Sales and Service Tax Number (SST) is a unique identification number assigned to a company or individual that is registered with the Royal Malaysian Customs Department (RMCD).

8. What is a Tax Identification Number (TIN)?

A Tax Identification Number (TIN), also known as an Income Tax Number, is a unique identification number that is assigned to individuals and business entities that are registered taxpayers with the Inland Revenue Board of Malaysia (IRBM).

TIN consist of a combination of the TIN Code and a set of numbers as follows:

| Category |

|

Example |

Individual TIN

(For e-invoice, individual taxpayers should provide TIN with a prefix of “IG”.) |

IG115002000

IG4040080091

IG56003500070 |

| Category |

TIN Code |

Example |

| Non-Individual TIN |

|

|

| 1 Companies |

C |

C20880050010 |

| 2 Cooperative Societies |

CS |

D4800990020 |

| 3 Partnerships |

D |

E91005500060 |

| 4 Employers |

E |

F10234567090 |

| 5 Associations |

F |

|

| 6 Non-Resident Public Entertainers |

FA |

|

| 7 Limited Liability Partnerships |

PT |

|

| 8 Trust Bodies |

TA |

|

| 9 Unit Trusts/ Property Trusts |

TC |

|

| 10 Business Trusts |

TN |

|

| 11 Real Estate Investment Trusts / Property Trust Funds |

TR |

|

| 12 Deceased Person's Estate |

TP |

|

| 13 Hindu Joint Families |

J |

|

| 14 Labuan Entities |

LE |

|

8.1 Where to find TINs?

a) Via online through MyTax at the following link:

https://mytax.hasil.gov.my ;

b) HASiL Live Chat;

c) HASiL Care Line at +603-8911 1000 / +603-8911 1100 (Overseas);

d) Customer Feedback Form at HASiL’s Official Portal

https://maklumbalaspelanggan.hasil.gov.my/Public/ ; or

e) Nearest HASiL Branch.

9. When can I receive the validated e-invoice?

Please allow up to 3 days from the date of request for the validated e-invoice sent to you.

10. How will I receive the validated e-invoice?

The validated e-invoice will be sent to the email address that you provided in the E-invoice Request Form. Please check your email inbox. If unavailable, please check the spam/junk folder. Alternatively, you can log in to myInvois Portal (

myinvois.hasil.gov.my) and retrieve the successful e-invoice document details.

11. Can I resubmit the E-invoice Request Form two times for the same receipt?

No, only one (1) submission is allowed for one sales receipt/order number. Customers are required to ensure all the information provided in the request form is true and complete before clicking “Create”.

If validation fails, please check the email notification and follow the instructions to edit your data in the E-Invoice Request Form.

12. Can taxpayers continue claiming for tax deduction / personal tax relief without an e-invoice?

Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing documentation until the legislation has been amended.

13. How to request a refund/exchange if I have requested the E-Invoice?

The customer is required to provide a validated e-invoice copy and original sales receipt to the cashier of any POPULAR bookstore within 7 days of purchase.

14. How does a POPULAR voucher/coupon affect the E-Invoice value?

For transactions that use vouchers, gift cards or loyalty points for payment, the value of vouchers, gift cards or loyalty points will be deducted, and the E-Invoice will show the nett amount.

For example: an item costs RM60, and the customer pays using RM50 vouchers, gift cards or loyalty points and cash RM10. The e-invoice will show the nett amount paid RM10. This is due to IRBM’s ruling on the treatment of vouchers, gift cards and loyalty points.

15. Who to contact if any questions regarding an e-invoice request?

Please contact our customer service if you have any queries.

For store purchases

E-mail:

[email protected]

For online purchases

E-mail:

[email protected]

.png)

.png)